The accounting Big Four giants – EY, Deloitte, KPMG and PwC – continued to dominate the global accounting market with over 74% market share and a combined revenues of over $157bn in 2020.

The International Accounting Bulletin annual survey of the global accounting market shows that despite the pandemic and raising regulatory concerns over the audit monopoly of the Big Four, little has changed in the structure of the market.

World Survey Free summary is available here.

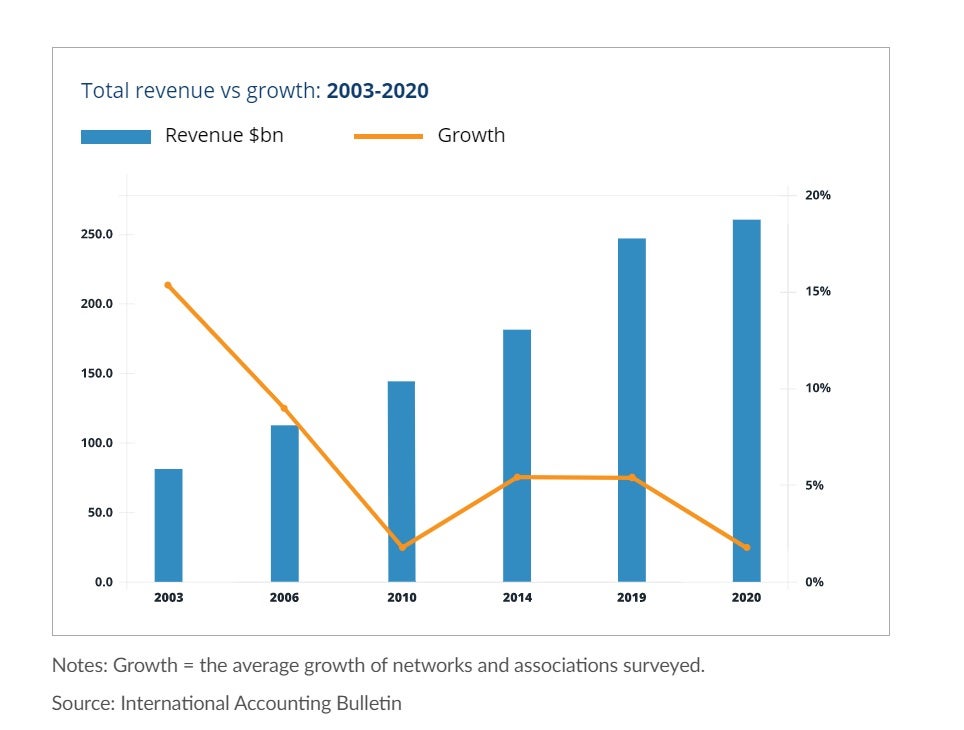

The IAB surveyed 52 organisations, comprising of 30 international accounting networks and 22 associations, earning a combined $241.4bn in fee income – up slightly from $234.5bn the previous year.

Average growth amongst networks in 2020 was 3%. The Big Four firms combined revenue increased by 1.5%, down from 4% in 2019, while the mid-tier networks combined revenues increased by 6% year-on-year. For associations the growth was only 2% in 2020, which is down from 14% in 2019.

Accounting market through time

Over time IAB data indicates that while market value has grown steadily with more organisation perusing a global presence, growth has been sluggish for over a decade since the global financial crisis of 2008.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataThe financial crash appears to have put a stop to double digit growth in the market, which was the norm in the years prior.

Continued success of advisory services

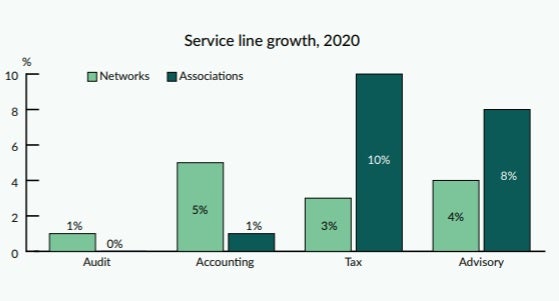

In the accounting giants arena traditional audit and accounting services continue to represent less and less of their fee income.

The largest of the Big Four firms, Deloitte, with total fee income of $47.6bn in 2020 only had 21% of that revenue come from audit and accounting. Deloitte’s largest business unit was advisory, which amounted to 61% of its overall fee income or $29.3bn, up 5% year-on-year, based on IAB data.

Overall, fee income increased by 4% for networks in advisory to $76.6bn, and 8% for associations to $5.4bn in 2020.

If you wish to view any of our 28 country surveys and the full World Survey reports please email us at briefings@verdict.co.uk . Free summary available here.